Governance and Ethics

Fostering a system of governance and accountability based on the principles of transparency, integrity, and independence, is key to ensuring operational excellence at Qatar Steel.

Qatar Steel’s commitment towards efficient and ethical leadership is driven by the company’s Corporate Governance Charter,which provides the principles for the Board of Directors in its foundation of independence and protecting shareholders’ rights.

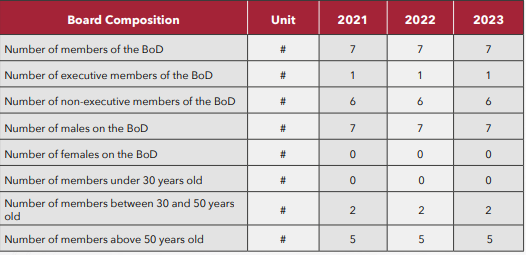

BOARD OF DIRECTORS

The Board of Directors, consisting of seven highly skilled members, is appointed by the sole shareholder, IQ. The key governing bodies within the corporation are the Board of Directors and the Board Audit Committee, which comprises Board members. Each member of the Board serves a three-year tenure.

To ensure ethical conduct, the Board of Directors has approved a Code of Ethics and Business Conduct Policy. Additionally, two members are appointed as Ethics Committee members to oversee conflicts of interest. Annually, a comprehensive declaration is signed by all board members, covering personal and business transactions, as well as identifying and addressing any conflicts of interest that may arise.

In the case of the Board of Directors, their remuneration is determined by IQ on a fixed basis in accordance with the Articles of Association (AOA).

The Board and Committees Performance Assessment Policy is part of the corporate governance structure put in place to assess the effectiveness of the Board of Directors and the Board Committees.

Compliance with Laws and Regulations

In 2010, Qatar Steel published a Code of Ethics and Business Conduct. The Code is available to all employees on the company’s intranet. On a yearly basis all employees are required to acknowledge their acceptance of the Code. Additionally, it is also shared with stakeholders based on their request or as per requirement on need-to-know basis.

The “Harassment Grievance Handling Policy” has been implemented and proven to be effective in our organisation.

RISK MANAGEMENT

Qatar Steel’s Integrated Enterprise Risk Management (ERM) framework is instrumental in driving value creation by facilitating the achievement of the company’s strategic, tactical, and operational objectives. This framework is supported by a culture that emphasises the importance of risk management at all levels of governance, including the Board, Board Audit Committee, Qatar Steel Risk Management Committee, and functional levels. Risk-based decision-making is ingrained in our culture, with risk assessments integrated into key decisions to mitigate business and strategic risks effectively. The ERM Framework is governed by the Qatar Steel Risk Management Policy, Qatar Steel Fraud Risk Management Policy, and Qatar Steel Business Continuity Management Policy. The Board Audit Committee has been entrusted with the oversight of these policies, ensuring that risks above the Qatar Steel Board Approved Risk Appetite and tolerance levels are properly mitigated or managed. Qatar Steel attended the Marsh Business Resilience Forum on the 15th of March 2023, where the 2023 Global Risks Report was presented and discussed with the participants. Our risk management draws from established frameworks such as the COSO Framework and ISO 31000:2018.

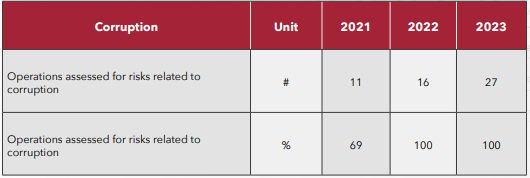

Fraud risks, including corruption risks, hold significant priority within Qatar Steel, as demonstrated by the implementation of a Fraud Risk Management Policy in 2021. All business areas have identified key fraud risks, including corruption, aligning them with the Company wide Risk Management Policy and Code of Ethics. All 27 departments/ functions were re-assessed for fraud/ corruption risks during the annual risk review exercises conducted annually.

Company-wide awareness sessions have been conducted, ensuring comprehensive risk identification and assessment throughout the value chain. Emphasis has been placed on internal controls to safeguard assets and regulate behaviours pertaining to fraud and corruption risks.

No contracts with business partners were terminated or not renewed due to violations related to corruption and during the reporting period there were no public legal cases regarding corruption brought against the organisation or its employees.

Over the coming years, we will gradually introduce risk stress testing and risk scenario analysis as essential inputs in our company’s strategy formulation and implementation. This exploration aims to assess the cost benefit value associated with these risk management tools. By incorporating them into our decision-making processes, we can gain valuable insights into potential risks, evaluate their impacts, and make informed strategic choices.

Risk Management Governance Strategy has been has been developed in line with QNV 2030, Qatar National Development Strategy, and guided by Qatar Energy’s Strategy. Some of the key objectives identified to mitigate climate related risks include the Reduction of GHG emissions and Leading the Energy transition in the Region. Progress on the respective mitigation measures that will enable the achievement of these objectives are regularly tracked and reported on a quarterly basis to the Qatar Steel Risk Management Committee, The Qatar Steel Board Audit Committee and the Qatar Steel Board of Directors meetings.

The Fraud Risk Management Policy at Qatar Steel includes monitoring of corruption risks and is aligned with the company’s Enterprise Risk Management Policy. Planed awareness sessions are conducted with risk champions across all business areas. Focus has been placed on introducing internal controls to safeguard assets and regulate behaviours pertaining to fraud and corruption risks.

Internal Audit

The role of Internal Audit remains pivotal in the governance and management systems of our company. It serves as a crucial assurance mechanism, ensuring that adequate systems, policies, and procedures are in place and being adhered to towards the achievement of the company’s objectives and the safeguarding of its assets.

Furthermore, the Internal Audit function provides reasonable assurance that the systems and procedures in place are being adhered, to ensure timely and accurate reporting to the directors, management, and stakeholders. Additionally, it assures that the policies and practices are in place to monitor the company’s compliance with appropriate laws and regulations.

The Board Audit Committee continues to provide valuable support to the Board in fulfilling its oversight responsibilities. This includes ensuring the integrity of the company’s financial statements and financial reporting processes, evaluating the effectiveness of internal control systems, and overseeing the internal audit processes As part of Continuous Professional Education (CPE) program, the Internal Audit team regularly participates in various seminars, webinars, and conferences. This helps them stay current with developments in the field of Internal Audit, learn new technologies and methods, and enhance their skills to be prepared for future business challenges.

Procurement Practices

In line with our strategic objective of Championing Sustainability Stewardship, we have established a series of targets related to our procurement practices.

These will be implemented progressively, with the aim being to have them all fully in place by the end of 2023. These targets include the development of a comprehensive ‘Supplier Code of Conduct’ and the creation of a ‘Responsible Sourcing’ Policy. Additionally, we will conduct a thorough assessment of all our suppliers to identify their sustainability impact in areas such as health and safety, environment, and human rights. Furthermore, an annual evaluation of suppliers based on environmental, social, and governance (ESG) factors will be conducted, with the outcomes of these assessments being reported in our sustainability reports.

As of today, we have tools in place such as Qatar Steel’s Governance Charter and Procurement Policy which serve as frameworks for implementing best practices in the supply chain management. In 2022 we introduced the Responsible Sourcing Policy7 which emphasises our will for fair business practices, health and safety, and environmental and human rights protection within supplier organisations. Qatar Steel expects all suppliers to comply with a Code of Ethics and Business Conduct policies.A thorough analysis of our suppliers has been conducted to identify key suppliers.The classification of these suppliers as “key” is determined by two primary factors: the volume of materials purchased from them and the corresponding spending. Based on this analysis, it has been concluded that the key suppliers are those from whom we procure the following raw materials: iron ore pellets, steel scrap, ferro silicon manganese, and ferro silicon.

For these suppliers, an evaluation sheet has been prepared based on ESG criteria, with the possible achievable score ranging from 0 to 100. Qatar Steel preferably engages with suppliers having scores higher than 50. Suppliers with established Environmental, Health, and Safety Management Systems are given priority through this scoring process, while those without such systems are encouraged to develop their own policies and governance frameworks. Furthermore, we encourage suppliers to adhere to human rights and labour practice standards, including ILO conventions on child and forced labour, nondiscrimination, and more. Also, criteria such as quality, delivery schedule, price, previous experience, financial background, and quality systems in place are assessed.

Qatar Steel’s main Raw Materials are:

• Iron Oxide Pellets, procured from suppliers having ISO 14001, ISO 45001 and ISO 9001 certifications and sustainability certification, and

• Steel Scrap wholly procured locally.

Presently, the suppliers screened for their environmental and social impacts are suppliers of key raw materials, i.e., oxide pellets, scrap, and ferroalloys. Qatar Steel intends to extend the list of suppliers subject to this screening in the future. In 2023 overall, approximately 85 % of key raw material suppliers are certified for ISO 9001,ISO 14001, and ISO 45001. Key raw material suppliers are evaluated on various environmental and social criteria. These include greenhouse gas emissions, air quality, waste management, water efficiency, biodiversity conservation, and energy efficiency. Additionally, they are assessed on social aspects such as occupational health and safety, ethical business practices, legal compliance, human rights, labor practices, and corporate social responsibility (CSR) initiatives. The suppliers are required to demonstrate the above compliance through certificates / Sustainability Reports/ third party evaluation reports.

In 2023, we screened seven key raw material suppliers for their environmental and social performances. There were no suppliers identified as having significant actual and potential negative environmental or social impacts with which improvements were agreed upon or terminated because of this assessment.

Additionally, since 2016, we hold the BRE BES 6001 Issue 3.1 responsible sourcing certification from CARES. This certification ensures that our construction products are manufactured using responsibly sourced materials. The BRE standard BES 6001 encompasses various aspects such as organisational governance, supply chain management, and environmental and social considerations, all of which must be addressed to ensure responsible sourcing of construction products.

In 2023, Qatar Steel attended the Fast Market Iron Ore Conference to meet new suppliers from all over the world and help strengthen our relationship with existing suppliers. These conferences presented and discussed topics related to Steel industry.